Understand that commercial real estate loans are nothing like residential loans, which means that the qualifications are drastically different as well. Understanding the qualifications before you apply for a loan is critical to securing the fund that you need.

First, it is important to grasp that commercial real estate loans and residential real estate loans have nothing really in common other than the word loans. The comparison is similar to that of a paper airplane and a jumbo jet; yes they both fly. So be prepared to learn about an entirely new set of loan qualifications before you embark on your first commercial loan application.

Lenders base a huge portion of their decision on your personal credit score when you are seeking a residential loan. And it is always good to have a respectable credit score, but it is not as critical when seeking a commercial loan. A credit score of below 600 will require an explanation but it is not a deal breaker. But a credit score of under 500 is likely to reduce your opportunities quite a bit. What lenders will be looking for to approve commercial real estate loans is a solid net worth. In general, lenders would like to see a net worth equal to the amount of the loan you are requesting.

Another important factor to qualify for commercial real estate loans is liquidity. The standard for liquidity varies among lenders but the rough average is 10-20% of the loan amount. What lenders don’t want to see is a borrower who scrapes up every last dollar that they have to make a down payment. Being cash poor could have catastrophic results if there is an unexpected expense which arises or some other type of emergency.

Your Experience

Your experience will also be a key factor in your approval. Demonstrating that you have the ability to manage the new property successfully means that you are most likely going to be able to make you payments on time and for the life of the loan. And if the property is quite large, the lender wants to know that you have the resources and staff in place to handle the management and ownership responsibilities associated with the property.

Income

As with any loan, there is a certain expectation for income. You need to have the income to pay the loan payment each month. This might be in the form of rental income once the property is up and functioning or it could be revenue from the business which is housed on the property, but the cash flow needs to be there to make the payments. Unlike on a residential loan, there is not real ratio such as debt to income that the industry uses as a standard. But you do need to demonstrate that there will be some type of cash flow to cover the loan payments for the life of the loan. All of these factors are blended to determine your ability to make the monthly payments on the loan that you are requesting unlike in a residential loan application where most of the weight rests on your income alone.

Dennis Dahlberg

Broker/RI/CEO/MLO

Level 4 Funding LLC Private Hard Money Lender

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

Dennis@level4funding.com NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

About the Author: Dennis has been working in the real estate industry in some capacity for the last 40 years. He purchased his first property when he was just 18 years old. He quickly learned about the amazing investment opportunities provided by trust deed investing and hard money loans. His desire to help others make money in real estate investing led him to specialize in alternative funding for real estate investors who may have trouble getting a traditional bank loan. Dennis is passionate about alternative funding sources and sharing his knowledge with others to help make their dreams come true. Dennis has been married to his wonderful wife for 42 years. They have 2 beautiful daughters 5 amazing grandchildren. Dennis has been an Arizona resident for the past 40 years.

Technorati Tags: commercial loans,commercial lending,commercial mortgage

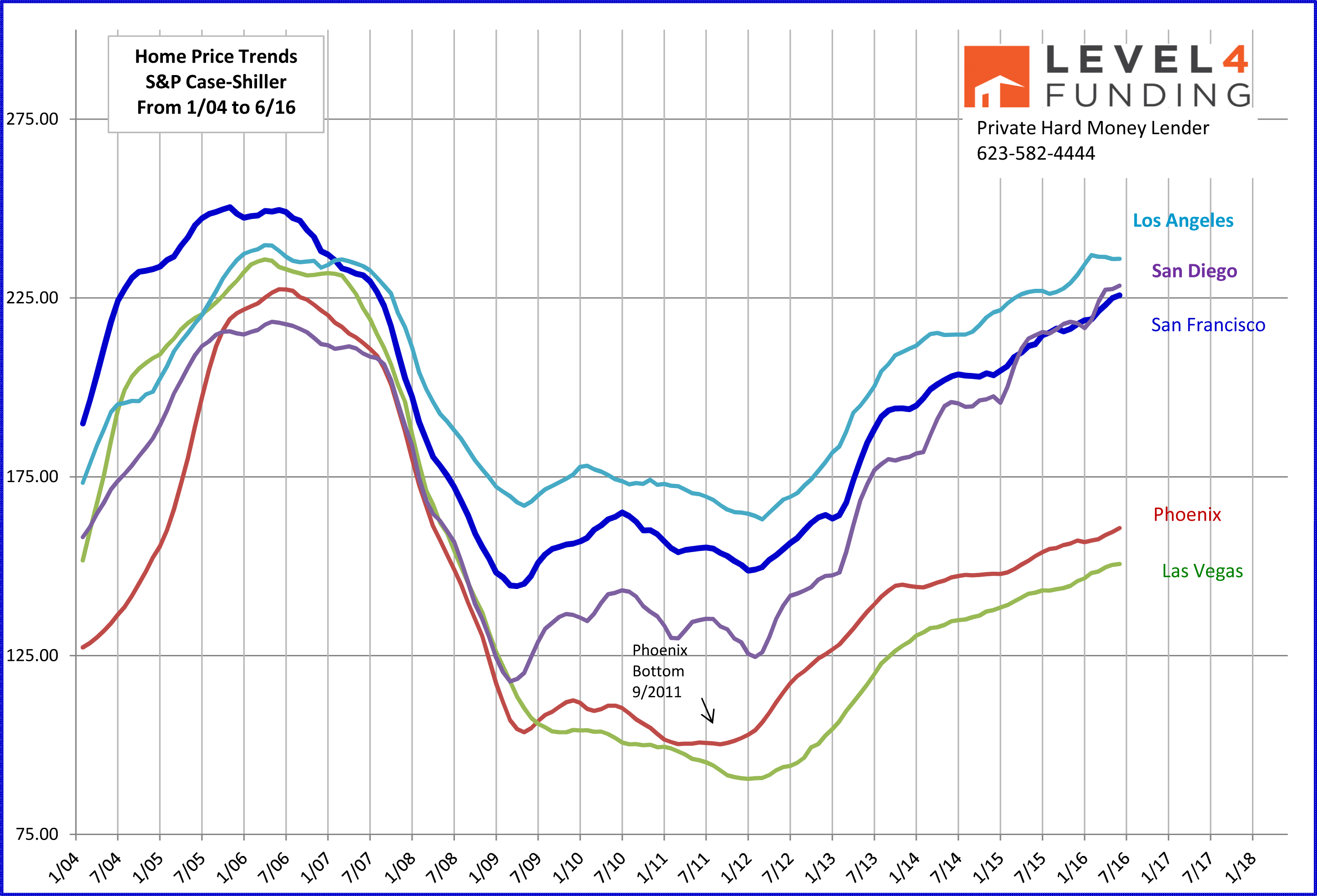

For Phoenix the bottom was officially September 2011.

For Phoenix the bottom was officially September 2011.![Level-4-Funding-Dennis-Dahlberg-Mort[1] Level-4-Funding-Dennis-Dahlberg-Mort[1]](https://lh3.googleusercontent.com/-aF-ke_K6CG4/V4Z0vHp_19I/AAAAAAAAJ30/J3B2tNpVP3o/Level-4-Funding-Dennis-Dahlberg-Mort.jpg?imgmax=800) Dennis Dahlberg

Dennis Dahlberg