People are buzzing

about USDA Home loans…but do you really know what they are all about? Why

should YOU apply for an Arizona USDA Home Loan? These loans can benefit you in many ways, but you need to know

the ins and outs before you get started.

It seems that there is an endless amount of ways to finance

a home in 2014. There’s FHA loans, conventional loans, loans that require money

down or no money down, loans for renovations, the list goes on and on. While

you can find a plethora of information online about home loans, let me fill you

in on an Arizona USDA Home Loan and

why you should consider applying for one.

Arizona USDA Home

Loan: What is it?

You’ll need to know the answer to this first before you

decide whether or not you’d like to apply for this loan. The first thing you

need to know is that this loan in particular has a lot of upsides with very

little catches. That’s the truth! Let’s explore the history first so you’ll be

able to better understand.

The USDA home loan was created by the US Department of

Agriculture with farmers in mind. However, it has benefited much more than that

specific group of people. The USDA wanted people who lived in rural areas and

low income households to be able to achieve that American dream we are all

looking for---home ownership. Thus, there’s nothing secretive about this loan,

there’s nothing you need to worry about, and no reason to be skeptical.

The

Arizona USDA Home Loan offers something that the majority of other loans do not—that is 100%

financing. That’s right. No money down. So even if you have been scrimping and

saving for a down payment, you can keep that money in the bank or put it toward

something else on your home because the USDA loan will finance it all. What’s

great about this loan too is that often times the seller pays closing costs.

When the seller doesn't pay closing costs, the buyer can have those expenses

rolled into the loan so you can literally move into a home without a single

penny out of pocket. The first expense you’ll have to put toward your new home

is simply your monthly mortgage payment.

Another upside to the Arizona

USDA Home Loan is that the interest rates are remarkably low. The days of

10-20% interest rates are long gone and most people looking into this loan are

able to finance a home for less than 7% interest. The USDA loan offers an

entire percentage rate lower than other loans.

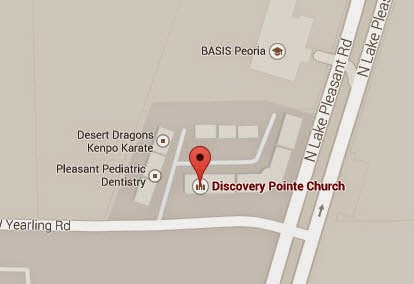

Perhaps one downside to the USDA loan in Arizona is that the

areas where you are allowed to buy a home with this type of financing are very

strictly defined. Since it is the US Department of Agriculture who developed

this loan, it is only logical that this loan is offered specifically in rural

areas. The USDA has a map on their website that describes which areas in

Arizona are eligible. Don’t be distraught though, you will probably be very

surprised to find that a lot of the areas you thought wouldn't qualify,

actually do!

The only other downside to this loan is that there is a cap

on your income. Essentially, you cannot make more than about 115% of the median

income for Arizona. For Arizona in particular, that averages out to about

$75,000 per year. But hey, if you’re making more than that, maybe you’re better

off anyway!

It’s pretty easy to qualify for the USDA home loan Arizona.

You’ll have to have your mortgage broker or real estate agent check your debt

to income ratio and make sure it is low. You don’t want to be paying a lot out

in credit card payments and other debts when you’re trying to make a purchase as

large as a home. When you factor the payments for the home you’re looking to

buy, you will only be able to qualify for the loan if it does NOT put your debt

to income ratio above 30%. This means that your monthly mortgage payment cannot

equal out to more than 1/3 of your gross monthly income. While frustrating to

some, this is actually a really wise eligibility requirement because it keeps

you from becoming “house poor” and upping your chances of foreclosure.

If you think a USDA loan might be right for you, don’t

hesitate to call your mortgage broker and see if you are eligible. Although

parts of it seem too good to be true, it really is a great option for

home buyers (ESPECIALLY first time home buyers) to consider. With no money down,

100% financing, and low interest rates, you really can’t beat it!

Dennis Dahlberg

Broker/RI/CEO/MLO

Level 4 Funding

LLC

Tel: (623) 582-4444 | Fax: (888) 279-6917

www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

23335 N 18th Drive Suite 120

Phoenix AZ 85027