You’ve probably heard that the best deal you can get with a California private hard money lender is one that has a reasonable or affordable interest rate, which in many ways is true. But, that’s not the only thing a good deal is about i.e. there are few more things you should negotiate with your lender to get the best deal.

Dealing with a California private hard money lender means that you are dealing with a skilled, business-savvy individual who is no stranger to how private money or hard money works. Consequently, even the most transparent lender still needs to a decent return on their investment. In other words, you can easily work with a reputable lender to get the best deal for your commercial business venture. But, if you leave all the negotiating in your lender’s hands, you are more than likely putting yourself at a disadvantage.

Obviously, it is a win-win situation if you get the best deal possible and your California private hard money lender receives a profitable return. So, how is this all possible? Well, let’s discuss the ins and outs of hard money deals so that a win-win solution is in your hard money future.

Obviously, it is a win-win situation if you get the best deal possible and your California private hard money lender receives a profitable return. So, how is this all possible? Well, let’s discuss the ins and outs of hard money deals so that a win-win solution is in your hard money future.

For starters, you know that your interest rate matters. Thus, you clearly want to settle on a rate that you are comfortable—that goes without saying. Moreover, when discussing that lovely interest rate make sure to also inquire about your default interest rate. Your default interest rate is just as important as your regular interest rate because in the event that you breach the terms of your hard money loan you need to know how much your overall rate is going to increase. Furthermore, you should negotiate your points with your potential lender. Points are essentially fees that you are responsible for at closing i.e. part of your closing costs. In addition to agreeing on a fair and reasonable number of points, you should also try to negotiate your underwriting fee, referral fee (if applicable), renewal fee (fee to renew your loan for another term), foreclosure fees (this fee is added to your loan balance) and/or your late fees (if you are unable to make a payment on time) as well as really any fee that you are potentially liable for.

Loan Servicing Advice

With that being said, another important component of hard money loans is loan servicing. Typically, a private investor will cover this particular fee or rather pay the hard money lending company in the event that the hard money lending company is the entity servicing your loan. If another entity or a third-party is handling the loan servicing, then make sure you are clear on who is responsible for paying the fee. In most cases, you may not be responsible for this particular fee, but, nevertheless, it is important to double check so there are no surprises down the road.

Avoid the Pitfalls

Ultimately, these above-mentioned fees, rates, and points are crucial things to hammer out with your lender. So, do yourself a favor and make sure your deal is truly the best possible deal because you’ve covered all your bases.

![Level-4-Funding-Dennis-Dahlberg-Mort[1] Level-4-Funding-Dennis-Dahlberg-Mort[1]](https://lh3.googleusercontent.com/-aF-ke_K6CG4/V4Z0vHp_19I/AAAAAAAAJ30/J3B2tNpVP3o/Level-4-Funding-Dennis-Dahlberg-Mort.jpg?imgmax=800) Dennis Dahlberg Broker/RI/CEO/MLO

Dennis Dahlberg Broker/RI/CEO/MLO

Level 4 Funding LLC

Arizona Tel: (623) 582-4444

Texas Tel: (512) 516-1177

Dennis@level4funding.com

http://www.Level4Funding.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112 | Phoenix | AZ | 85027

111 Congress Ave |Austin | Texas | 78701

About the author: Dennis has been working in the real estate industry in some capacity for the last 40 years. He purchased his first property when he was just 18 years old. He quickly learned about the amazing investment opportunities provided by trust deed investing and hard money loans. His desire to help others make money in real estate investing led him to specialize in alternative funding for real estate investors who may have trouble getting a traditional bank loan. Dennis is passionate about alternative funding sources and sharing his knowledge with others to help make their dreams come true.

Dennis has been married to his wonderful wife for 42 years. They have 2 beautiful daughters 5 amazing grandchildren. Dennis has been an Arizona resident for the past 40 years.

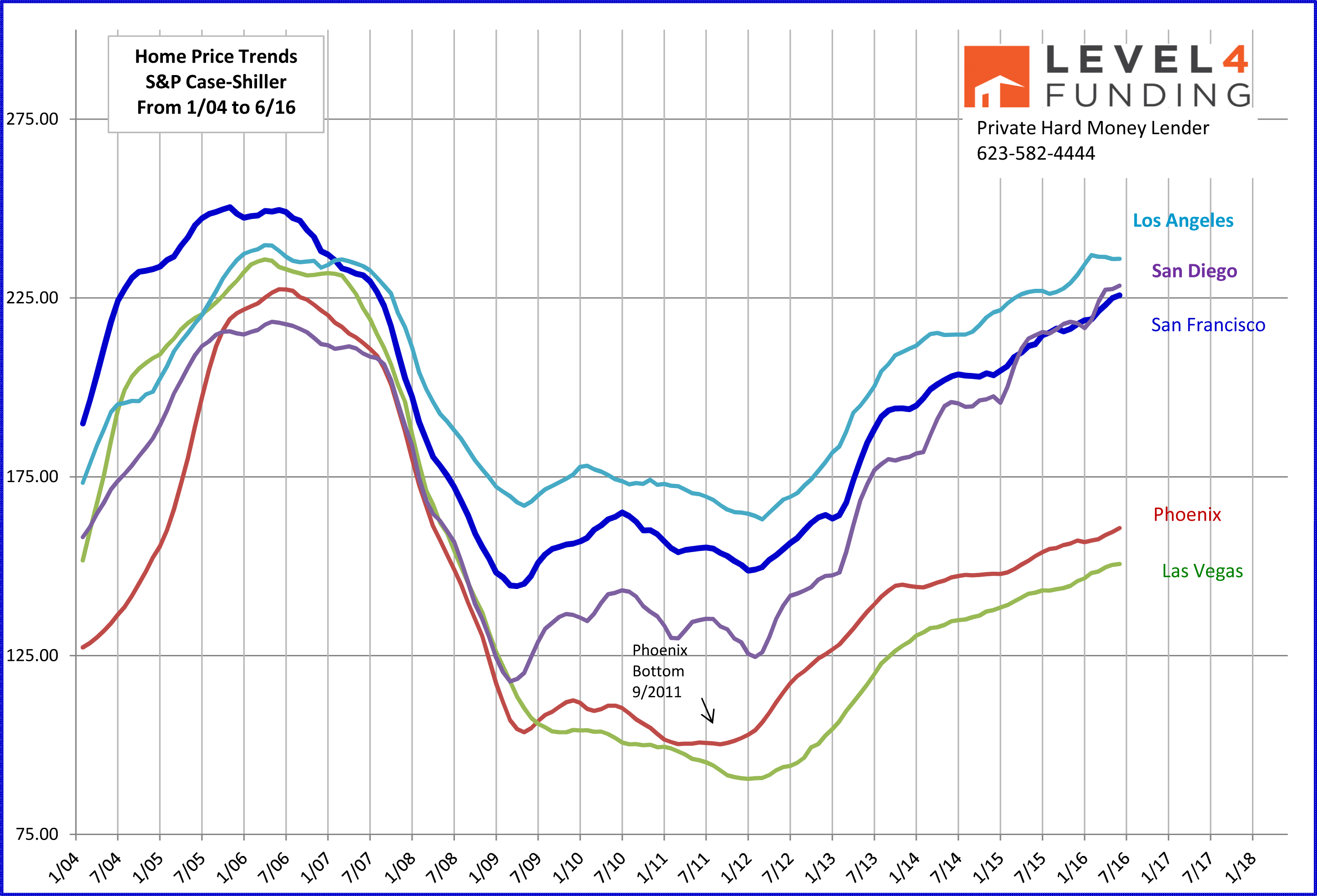

For Phoenix the bottom was officially September 2011.

For Phoenix the bottom was officially September 2011.